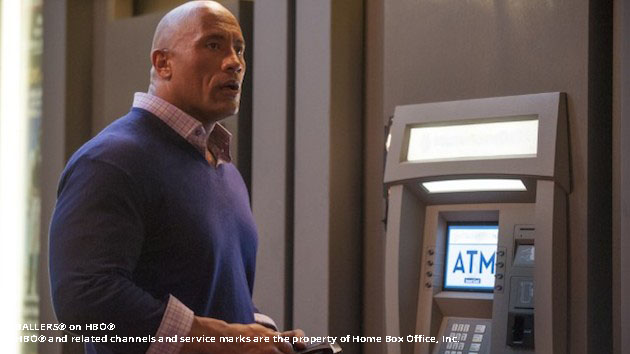

Financial Advice from Ballers' Dwayne Johnson — and Real-Life Players-Turned-Money Managers

Dwayne Johnson offers this warning in the new HBO show Ballers, which premieres June 21: “Football has a way of making a man feel invincible.”

But when it comes to money, even the game’s biggest stars are anything but invincible. To name just a few: Warren Sapp, Terrell Owens, Dan Marino, Jamal Lewis, and Vince Young all lost fortunes.

That’s where Johnson comes in. He plays former pro football player Spencer Strassmore, who is trying to reinvent himself as a financial adviser who just can’t shake the game—or commoditizing friendships with players who need his help.

According to a recent report in the Washington Post, one in every six NFL players files for bankruptcy within 12 years of retirement, and the rates of failure for the stars was just as high as for the bench players. In 2009, a Sports Illustrated article painted an even more dire picture: “By the time they have been retired for two years, 78% of former NFL players have gone bankrupt or are under financial stress because of joblessness or divorce.”

With that in mind, Johnson offers this wisdom to his clients: “First piece of free advice: if it drives, flies or floats … lease it.”

Heed these words, young ballers!

It’s certain that these real-life players-turned-money mangers would agree with it. And here’s what else they would tell an aspiring NFL player, whose median career will earn $3.2 million over six years in 2000 dollars.

Former NFL linebacker Reggie Wilkes

“I love watches. They’re my weakness. I realized: How many watches can you wear on one arm in one day anyway?”

Wilkes also asks his clients to save $1 million as quickly as they can.

“During my time in football, I watched teammates fall on their faces financially after the end of their career. I felt there was a need for someone to support their efforts to overcome the cycle of financial failure. Athletes are a different breed - you have to approach their goals and objectives differently because their careers could last anywhere between five and 15 years. They still have a majority of their lives to live and pay for. I wanted to be a part of the solution.”

Former NFL quarterback Scott Hunter

“Fans don’t normally see it, but players have a plan to get ready for the season and conditioning. Each team has a plan, too, and there’s a plan for each week involving the team you are playing. Having plans is paramount to being a good athlete and a good team. There’s always a plan going on. It’s just like I tell clients who see a photo of me with (Bear) Bryant telling me something on the sidelines.”

Former NFL cornerback Eugene Profit

“Let’s say you have $5,000 and the portfolio pays 10 percent. If I tell you it becomes $10,000 in a little over seven years, you’re not too excited about that. But the same principle works with larger amounts, such as $100,000. The trick is if you get started with the smaller amount, it opens the door for larger returns down the road. A lot of people don’t get started or they don’t stick with it.”

Former NFL linebacker Willie Thomas

“It takes a strong work ethic, on and off the field. Clear, short-term goals also need to be (in place) for professional development and to underlie success — both personal and professional accomplishments. From high school to college and on to my professional careers, short-term success led to long-term success for me. … The way you invest money should not deviate from your personal goals and your values in life.”